This beautiful waterfront property at 4470 Pebble Lake Drive is under contract! Learn more about how the Karin Head Team can help you buy or sell a home by calling 336.283.8687 or go to www.karinheadteam.com . #karinheadteam#exprealtyproud #undercontract

Buying a House This Year? This Should Be Your 1st Step!

In many markets across the country, the number of buyers searching for their dream homes outnumbers the number of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show that you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.

Even if you are not in an incredibly competitive market, understanding your budget will give you the confidence of knowing whether or not your dream home is within your reach.

Freddie Mac lays out the advantages of pre-approval in the ‘My Home’ section of their website:

“It’s highly recommended that you work with your lender to get pre-approved before you begin house hunting. Pre-approval will tell you how much home you can afford and can help you move faster, and with greater confidence, in competitive markets.”

One of the many advantages of working with a local real estate professional is that many have relationships with lenders who will be able to help you through this process. Once you have selected a lender, you will need to fill out their loan application and provide them with important information regarding “your credit, debt, work history, down payment and residential history.”

Freddie Mac describes the ‘4 Cs’ that help determine the amount you will be qualified to borrow:

Capacity: Your current and future ability to make your payments

Capital or cash reserves: The money, savings, and investments you have that can be sold quickly for cash

Collateral: The home, or type of home, that you would like to purchase

Credit: Your history of paying bills and other debts on time

Getting pre-approved is one of many steps that will show home sellers that you are serious about buying, and it often helps speed up the process once your offer has been accepted.

Bottom Line

Many potential homebuyers overestimate the down payment and credit scores necessary to qualify for a mortgage. If you are ready and willing to buy, you may be pleasantly surprised at your ability to do so today.

Beautiful Home Just Listed!

1000 Wild Dogwood Lane | Winston Salem

Beautiful 4 bedroom, 3 1/2 bath home in desirable Century Oaks. Master suite on the main floor, gorgeous heart of pine hardwoods, huge kitchen, tons of storage, finished basement with half bath, and second main level driveway at the kitchen entrance. Great floor plan, freshly painted, and spacious large yard with beautiful main level deck. Great neighborhood with swimming pool, clubhouse, playground and access to greenway for walking. Hurry, this one won't last!

http://bit.ly/1000WildDogwoodLn

Just Listed in Clemmons!

135 Meadowfield Run | Clemmons

Come see this beautiful 5 bedroom / 3.5 bath home in Clemmons! Low Davidson county taxes! Enjoy the details with this open floor plan - columns, mouldings, too many to mention! Large bright and airy two story den is the perfect spot to have friends and family gatherings! Spacious kitchen with large pantry and white cabinets. LOTS of storage! Enjoy the screen porch overlooking a large fenced lot with storage shed!

Buying A Vacation Property? Now Is A Good Time!

Every year around this time, many homeowners begin the process of preparing their homes in case of extreme winter weather. Some others skip winter all together by escaping to their vacation homes in a warmer climate.

For those homeowners staying at their first residence, AccuWeather warns:

“The late-week cold shot should fade next week, but this is a warning shot for winter’s return late in the month and early February.”

Given this, it’s time to go and stock up on winter weather supplies! However, if you’re tired of shoveling snow and dealing with the cold weather, maybe it’s time to consider obtaining a vacation home!

According to the Investment & Vacation Home Buyers 2018 Report by NAR:

“72% of vacation property owners and 71% of investment property owners believe now is a good time to buy.”

It’s time to take advantage of the equity in your home. As the latest Equity Report from ATTOM Data Solutions stated:

“Nearly 14.5 million U.S. properties (are) equity rich — where the combined estimated amount of loans secured by the property was 50 percent or less of the property’s estimated market value — up by more than 433,000 from a year ago to a new high as far back as data is available, Q4 2013.

The 14.5 million equity rich properties in Q3 2018 represented 25.7 percent of all properties with a mortgage.”

This means that over a quarter of Americans who have a mortgage would be able to use some of their home equity to make a significant down payment toward a vacation home, and many are doing just that! According to the same report by NAR:

“33% of vacation buyers purchased in a beach area, 21% purchased on a lakefront, and 15% purchased a vacation home in the country.”

Many homeowners who are close to retirement will use some of their equity to purchase vacation homes, which may eventually become their permanent homes post-retirement!

Bottom Line

If you are a homeowner looking to take advantage of your home equity by investing in a vacation home, let’s get together to discuss your options!

Top Renovations to Complete Before You Sell Your House

Some Highlights:

If you are planning on listing your house for sale this year, here are the top four home improvement projects that will net you the most Return on Investment (ROI).

Minor bathroom renovations can go a long way toward improving the quality of your everyday life and/or impressing potential buyers.

Upgrading your landscaping or curb appeal helps get buyers in the door. These upgrades rank as the 2nd and 4th best renovations for returns on investment.

Why You Should Not For Sale By Owner

In today’s market, as home prices rise and a lack of inventory continues, some homeowners may consider trying to sell their homes on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons why this might not be a good idea for most sellers.

Here are the top five reasons:

1. Exposure to Prospective Buyers

According to NAR’s 2018 Profile of Home Buyers and Sellers, 95% of buyers searched online for a home last year. That is in comparison to only 13% of buyers looking at print newspaper ads. Most real estate agents have an Internet strategy to promote the sale of your home, do you?

2. Results Come from the Internet

Where did buyers find the homes they actually purchased?

50% on the Internet

28% from a real estate agent

7% from a yard sign

1% from newspapers

The days of selling your house by putting out a lawn sign or putting an ad in the paper are long gone. Having a strong Internet strategy is crucial.

3. There Are Too Many People to Negotiate With

Here is a list of some of the people with whom you must be prepared to negotiate if you decide to For Sale by Owner:

The buyer who wants the best deal possible

The buyer’s agent who solely represents the best interests of the buyer

The buyer’s attorney (in some parts of the country)

The home inspection companies, which work for the buyer and will almost always find some problems with the house

The appraiser if there is a question of value

4. FSBOing Has Become More And More Difficult

The paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 7% over the last 20+ years.

5. You Net More Money When Using an Agent

Many homeowners believe that they can save on the real estate commission by selling on their own, but they don’t realize that the main reason buyers look at FSBOs is because they also believe that they can save on the real estate agent’s commission. The seller and buyer can’t both save the commission.

A study by Collateral Analytics revealed that FSBOs don’t actually save anything, and in some cases may be costing themselves more, by not listing with an agent. One of the main reasons for the price difference at the time of sale is that,

“Properties listed with a broker that is a member of the local MLS will be listed online with all other participating broker websites, marketing the home to a much larger buyer population. And those MLS properties generally offer compensation to agents who represent buyers, incentivizing them to show and sell the property and again potentially enlarging the buyer pool.”

If more buyers see a home, the greater the chances are that there could be a bidding war for the property. The study showed that the difference in price between comparable homes of size and location is currently at an average of 6% this year.

Why would you choose to list on your own and manage the entire transaction when you can hire an agent and not have to pay anything more?

Bottom Line

Before you decide to take on the challenges of selling your house on your own, let’s get together to discuss your needs.

Just Listed in Clemmons West

6972 Bridgewood Road | Clemmons

Beautiful Clemmons West home with large fenced yard! Neutral paint with updated hardware and light fixtures throughout. Circle drive, double level decks, and large storage shed. Bright, finished, walkout basement! Huge master bath and walk in closet. Laundry upstairs with bedrooms! Laminate and tile throughout, no carpet!

http://bit.ly/6972BridgewoodRd

What Makes a House a Home For You?

We frequently talk about why it makes sense to buy a home financially, but more often than not the emotional reasons are the more powerful or compelling ones.

No matter what shape or size your living space is, the concept and feeling of a home can mean different things to different people. Whether it’s a certain scent or a favorite chair, the emotional reasons why we choose to buy our own homes are typically more important to us than the financial ones.

1. Owning your home offers stability to start and raise a family

From the best neighborhoods to the best school districts, even those without children at the time of purchase may have this in the back of their minds as a major reason for choosing the location of the home that they purchase.

2. There’s no place like home

Owning your own home offers you not only safety and security, but also a comfortable place that allows you to relax after a long day!

3. You have more space for you and your family

Whether your family is expanding, an older family member is moving in, or you need to have a large backyard for your pets, you can take all this into consideration when buying your dream home!

4. You have control over renovations, updates, and style

Looking to actually try one of those complicated wall treatments that you saw on Pinterest? Tired of paying an additional pet deposit for your apartment building? Or maybe you want to finally adopt that puppy or kitten you’ve seen online 100 times? Who’s to say that you can’t do all of these things in your own home?

Bottom Line

Whether you are a first-time homebuyer or a move-up buyer who wants to start a new chapter in your life, now is a great time to reflect on the intangible factors that make a house a home.

Under Contract in Just 2 Days!

2447 Stratford Lake Road is under contract after just 2 days!! Ready to buy or sell a home? We can help! Call the Karin Head Team today at 336.283.8687 to put us to work for you! Or learn more at www.karinheadteam.com #exprealtyproud#karinheadteam #undercontract #2days

5 Reasons to Sell This Winter!

Here are five reasons listing your home for sale this winter makes sense.

1. Demand Is Strong

The latest Buyer Traffic Report from the National Association of Realtors (NAR) shows that buyer demand remains strong throughout the vast majority of the country. These buyers are ready, willing and able to purchase… and are in the market right now! More often than not, multiple buyers are competing with each other to buy a home.

Take advantage of the buyer activity currently in the market.

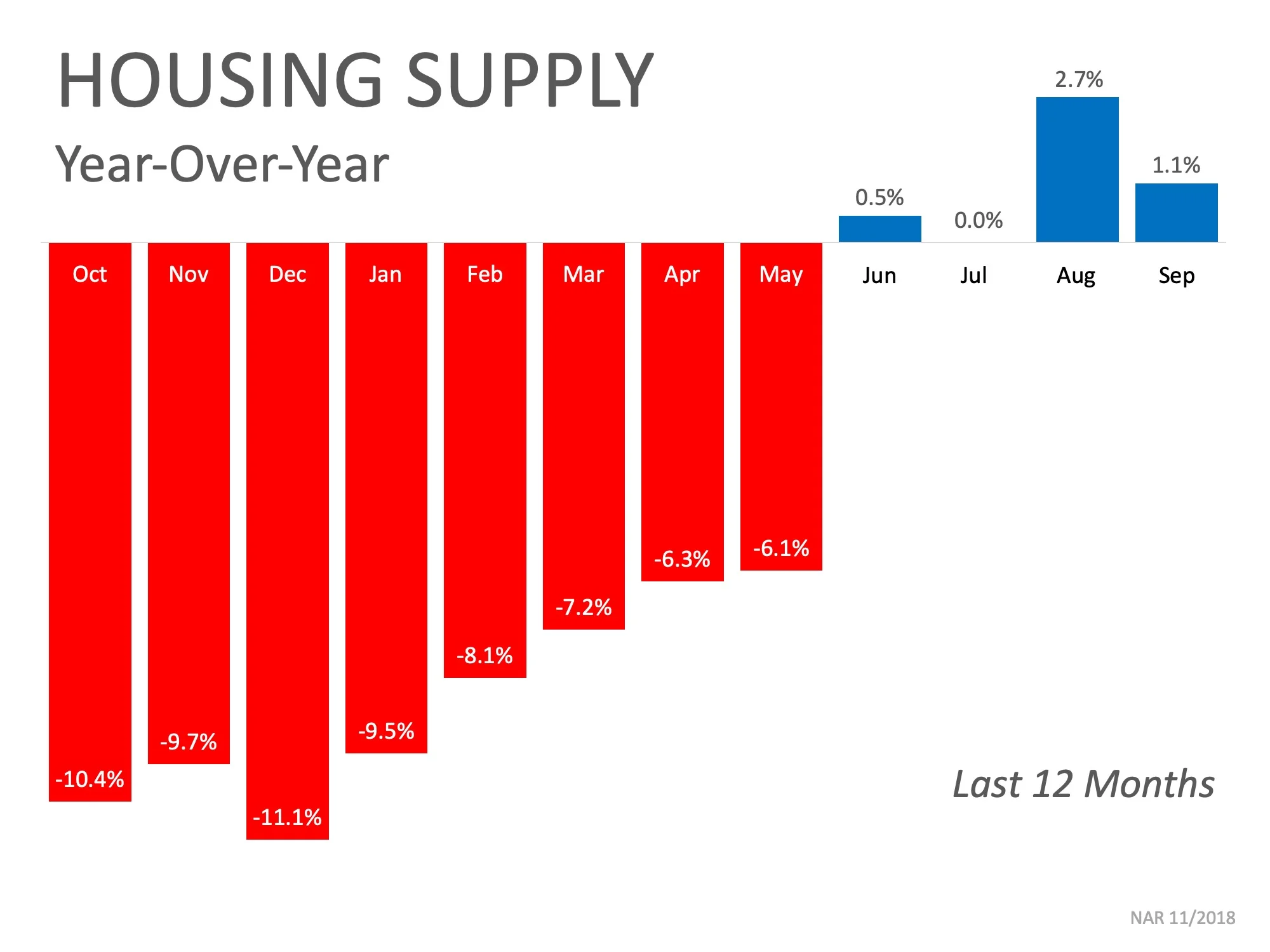

2. There Is Less Competition Now

Housing inventory is still under the 6-month supply that is needed for a normal housing market. This means that, in the majority of the country, there are not enough homes for sale to satisfy the number of buyers in the market. This is good news for homeowners who have gained equity as their home values have increased. However, additional inventory could be coming to the market soon.

Historically, the average number of years a homeowner stayed in their home was six but has hovered between nine and ten years since 2011. There is a pent-up desire for many homeowners to move, as they were unable to sell over the last few years because of a negative equity situation. As home values continue to appreciate, more and more homeowners will be given the freedom to move.

The choices buyers have will continue to increase. Don’t wait until this other inventory comes to market before you decide to sell.

3. The Process Will Be Quicker

Today’s competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. This makes the entire selling process much faster and much simpler as buyers know exactly what they can afford before home shopping. According to Ellie Mae’s latest Origination Insights Report, the time to close a loan has dropped to 46 days.

4. There Will Never Be a Better Time to Move Up

If your next move will be into a premium or luxury home, now is the time to move up! The inventory of homes for sale at these higher price ranges has forced these markets into a buyer’s market. This means that if you are planning on selling a starter or trade-up home, your home will sell quickly, AND you’ll be able to find a premium home to call your own!

Prices are projected to appreciate by 4.8% over the next year according to CoreLogic. If you are moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage payment) if you wait.

5. It’s Time to Move on With Your Life

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should?

Only you know the answers to the questions above. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire.

That is what is truly important.

JUST LISTED! GREAT PRICE!

2595 Charton Place | Winston Salem

Charming three bedroom, two bedroom home convenient to Wake Forest. Perfect investment property! Great floor plans features a large kitchen with eat-in area, sliding doors to the back deck, tons of counter space, and cabinets. Spacious den with vaulted ceiling, laminate floors and fireplace. Master bedroom suite includes a dual vanity in bath, separate shower and walk-in closet. Great school district, convenient location, this home won't last!

http://bit.ly/2595ChartonPlace

Don’t Get Caught in the Rental Trap in 2019

Every year around this time, we take time to reflect and plan for next year. If you are renting your current home but have dreams of homeownership, your plan for the new year may include buying, and you wouldn’t be alone!

According to the 2018 Bank of America Homebuyer Insights Report, 74% of renters plan on buying in the next 5 years, with 38% planning to buy in the next 2 years!

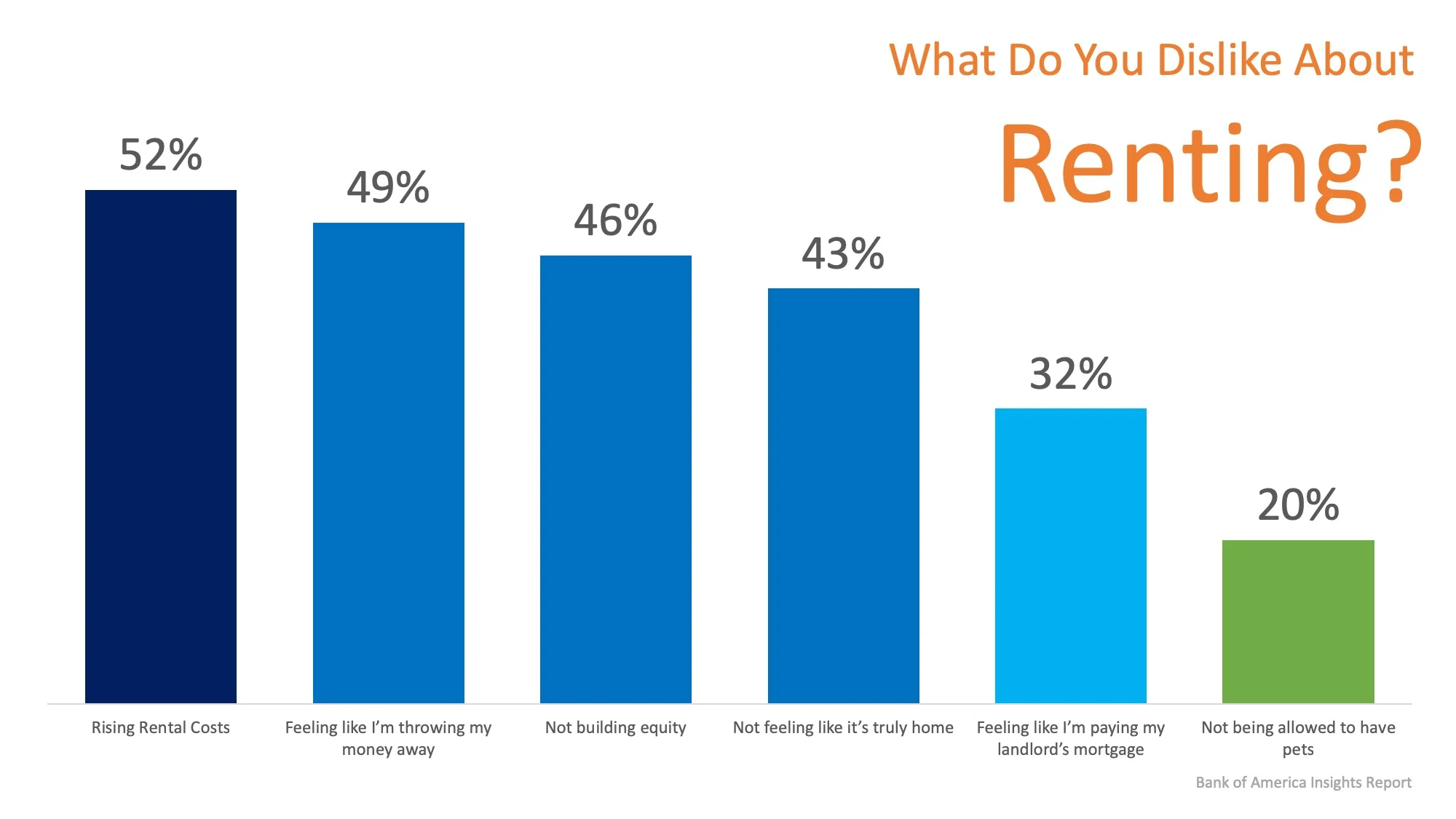

When those same renters were asked why they disliked renting, 52% said that rising rental costs were their top reason, and 42% of renters believe that their rent will rise every year. The full results of the survey can be seen below:

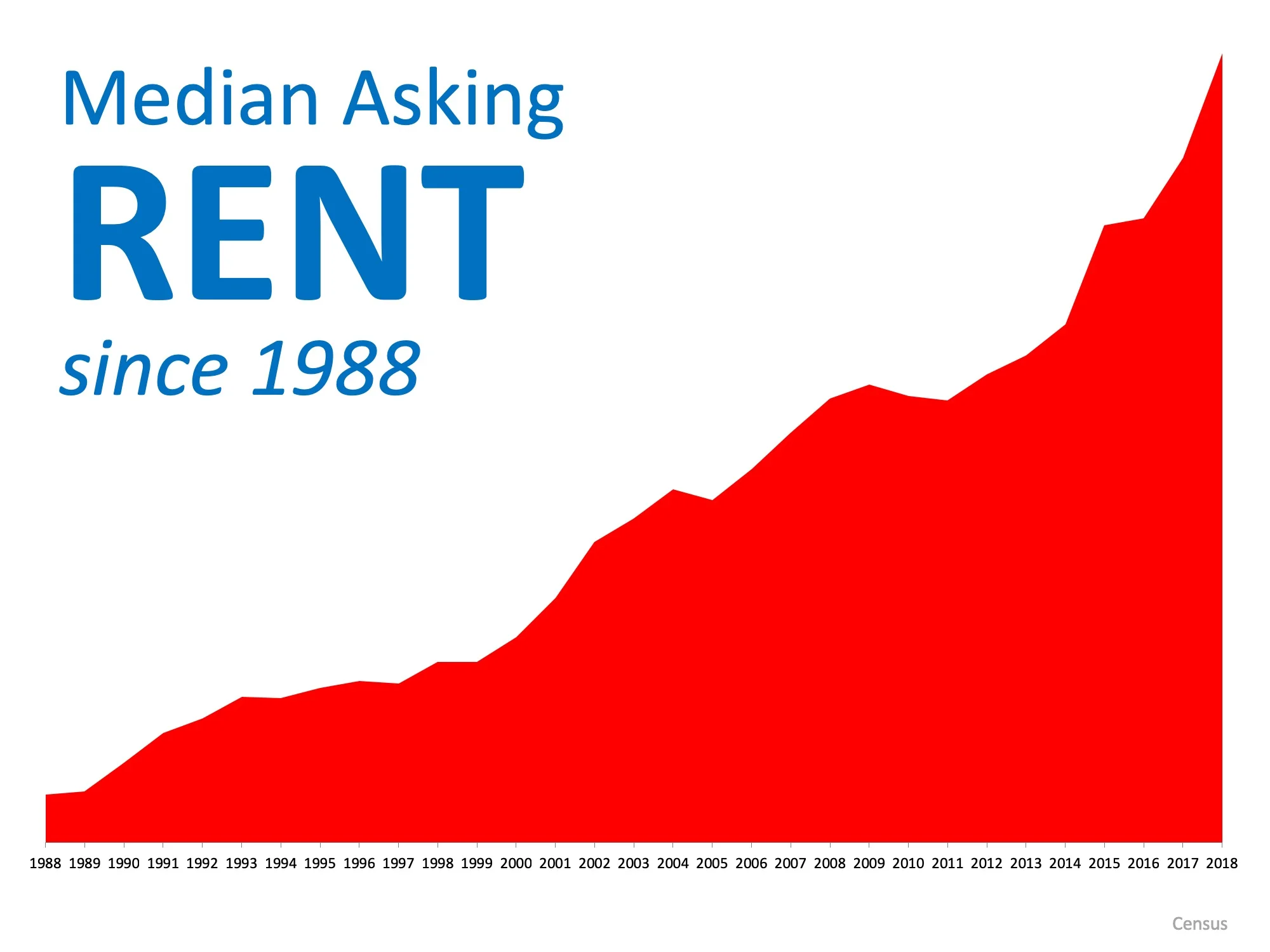

It’s no wonder that rising rental costs came in as the top answer! The median asking rent price has risen steadily over the last 30 years, as you can see below!

There is a long-standing rule that a household should not spend more than 28% of its income on housing expenses. With nearly half of renters (48%) surveyed already spending more than that, and with their rents likely to rise again… why are they renting?

When asked why they haven’t purchased a home yet, not having enough saved for a down payment (44%) came in as the top response. The report went on to reveal that nearly half of all respondents believe that “a 20% down payment is required to buy a home.”

If the majority of those who believe they haven’t saved a large enough down payment believe that they need 20% down to buy, that means a large number of renters may be able to buy now!

Bottom Line

If you are one of the many renters who is fed up with rising rents but may be confused about what is required to buy in today’s market, let’s get together to help you on your path to homeownership.

Buyers: Don’t Be Surprised by Closing Costs!

Many homebuyers think that saving for their down payment is enough to buy the house of their dreams, but what about the closing costs that are required to obtain a mortgage?

By law, a homebuyer will receive a loan estimate from their lender 3 days after submitting their loan application and they should receive a closing disclosure 3 days before the scheduled closing on their home. The closing disclosure includes final details about the loan and the closing costs.

But what are closing costs anyway?

According to Trulia:

“Closing costs are lender and third-party fees paid at the closing of a real estate transaction, and they can be financed as part of the deal or be paid upfront. They range from 2% to 5% of the purchase price of a home. (For those who buy a $150,000 home, for example, that would amount to between $3,000 and $7,500 in closing fees.)”

Keep in mind that if you are in the market for a home above this price range, your costs could be significantly greater. As mentioned before,

Closing costs are typically between 2% and 5% of your purchase price.

Trulia continues to give great advice, saying that:

“…understanding and educating yourself about these costs before settlement day arrives might help you avoid any headaches at the end of the deal.”

Bottom Line

Speak with your lender and agent early and often to determine how much you’ll be responsible for at closing. Finding out that you’ll need to come up with thousands of dollars right before closing is not a surprise anyone is ever looking forward to.

4 Reasons to Buy A Home This Winter!

Here are four great reasons to consider buying a home today instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Insight report revealed that home prices have appreciated by 5.6% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.7% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have hovered around 4.8%. Most experts predict that rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison, projecting that rates will increase in 2019.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way, You are Paying a Mortgage

There are some renters who have not yet purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person building that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move on With Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over renovations, maybe now is the time to buy.

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Work Hard, Play Hard, No Drama, Give Big!

An article about our fearless leader!

The #1 Reason to Not Wait Until Spring to Sell Your House

Many sellers believe that spring is the best time to place their homes on the market because buyer demand traditionally increases at that time of year, but what they don’t realize is that if every homeowner believes the same thing, then that is when they will have the most competition!

The #1 Reason to List Your Home in the Winter Months is Less Competition!

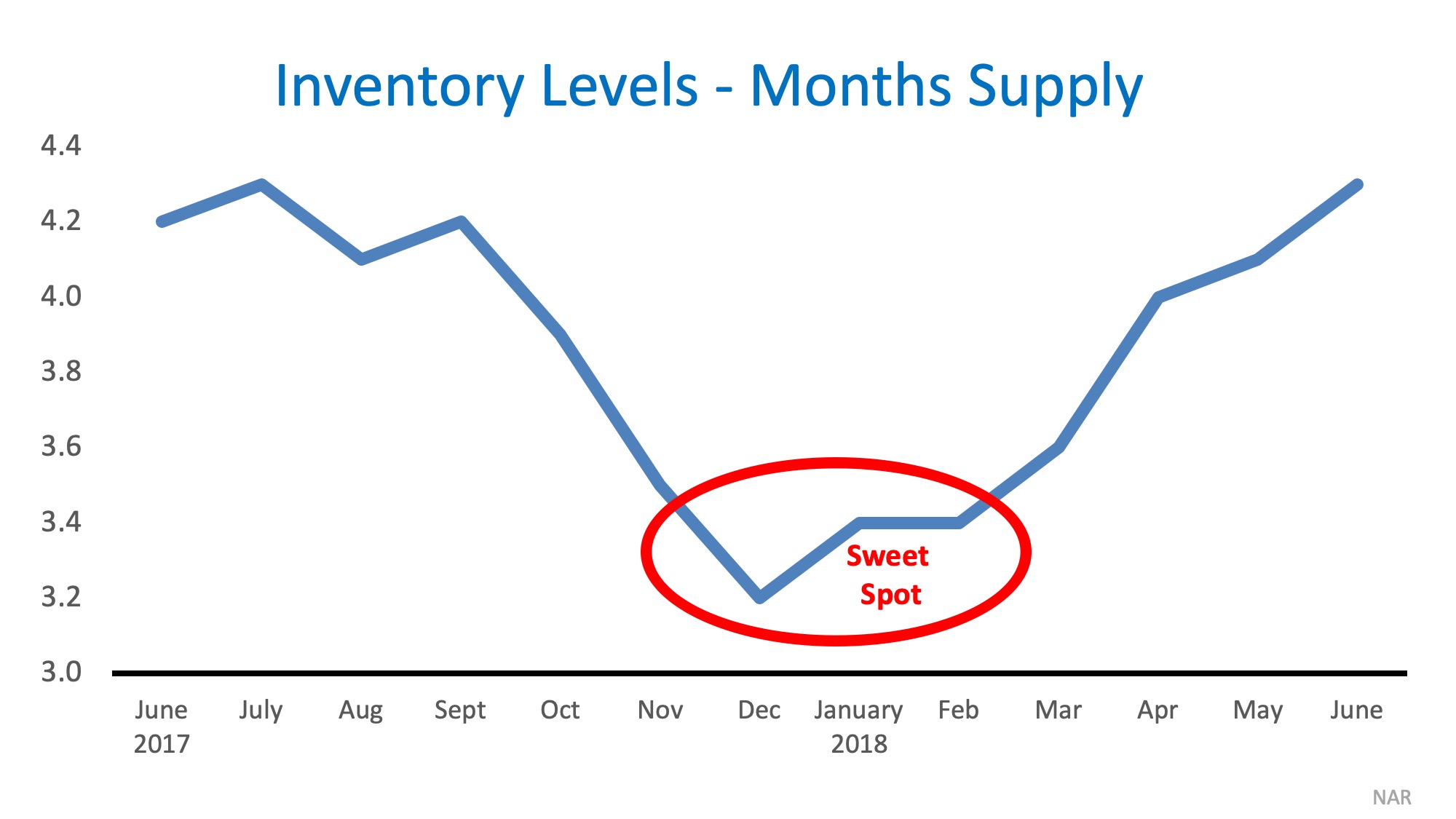

Housing supply traditionally shrinks at this time of year, so the choices buyers have will be limited. The chart below was created using the months’ supply of listings from the National Association of Realtors.

As you can see, the ‘sweet spot’ to list your home for the most exposure naturally occurs in the late fall and winter months (November – February).

Temperatures aren’t the only thing that heats up in the spring – so do listings!

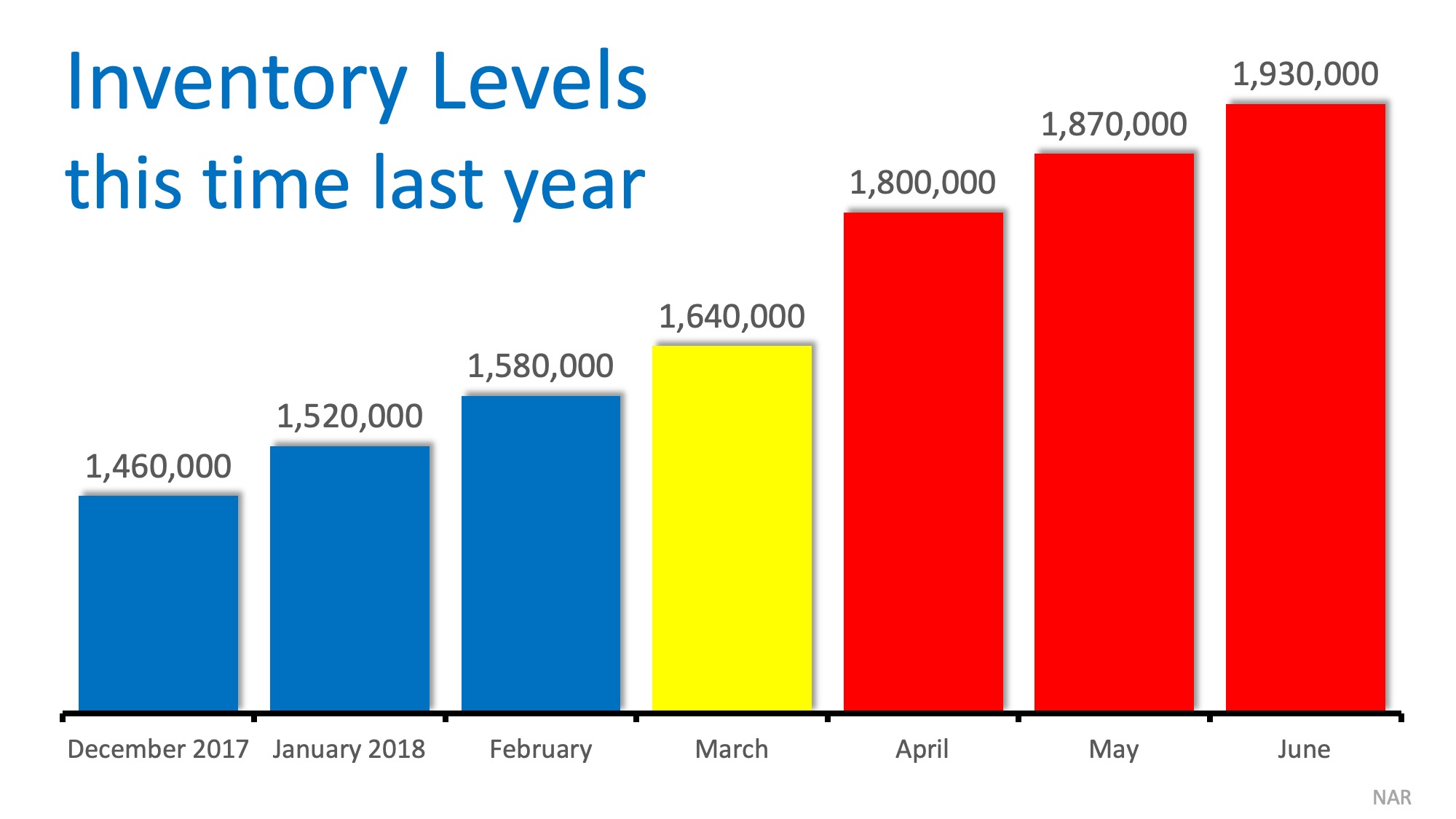

In 2017, listings increased by nearly half a million houses from December to June. Don’t wait for these listings to come to market before you decide to list your house.

Added Bonus: Only Serious Buyers Are Out in the Winter

At this time of year, only those purchasers who are serious about buying a home will be in the marketplace. You and your family will not be bothered and inconvenienced by mere ‘lookers.’ The lookers are at the mall or online doing their holiday shopping.

Bottom Line

If you have been debating whether or not to sell your home and are curious about market conditions in your area, let’s get together to help you decide the best time to list your house for sale.

Just Listed!

192 Kinloch Court | Winston Salem

Location, location, location! Charming 2 bedroom / 1.5 bath condo near shopping, restaurants and easy access to Hwy 421! Great open and airy living area with lovely eat-in kitchen! Lots of updates! Main level living at its best! This is the one you have been looking for!

7 Reasons to List Your House For Sale This Holiday Season

Every year at this time there are many homeowners who decide to wait until after the holidays to list their homes for the first time, while others who already have their homes on the market decide to take them off until after the holidays.

Here are seven great reasons not to wait:

Relocation buyers are out there. Many companies are still hiring throughout the holidays and need their new employees in their new positions as soon as possible.

Purchasers who are looking for homes during the holidays are serious buyers and are ready to buy now.

You can restrict the showings on your home to the times you want it shown. You will remain in control.

Homes show better when decorated for the holidays.

There is minimal competition for you as a seller right now. Inventory of homes for sale traditionally slows in the late fall, early winter. Let’s take a look at listing inventory as compared to the same time last year:

The desire to own a home doesn’t stop when the holidays come. Buyers who were unable to find their dream homes during the busy spring and summer months are still searching!

The supply of listings increases substantially after the holidays. Also, in many parts of the country, new construction will continue to surge and reach new heights which will lessen the demand for your house in 2019.

Bottom Line

Waiting until after the holidays to sell your home probably doesn’t make sense.

SOLD!

373 Lucinda Lane sold after just 2 days on the market! We can help you too! Call the Karin Head Team at 336.283.8687 to see what we can do for you!